Contactless bank cards and mobile wallets coupled with the availability of onboard cellular data technology for transit vehicles has made possible a new era in fare collection. Open payment promises to be one of the most significant changes in fare collection in more than 20 years.

Contactless payment is in more accepted in the U.S. and is becoming more common as a way to pay a transit fare. This paper addresses questions that transit agencies are likely to ask as they consider whether to accept open payment media.

What is open payment?

Open payment may be the most significant change in fare collection since the introduction of agency-issued smart cards more than 20 years ago. The adoption of contactless payment bank cards and mobile wallets, coupled with the availability of onboard cellular data technology for transit vehicles, has made possible a new era in North American fare collection.

Open payment enables riders to pay transit fares with the same credit and debit cards and mobile wallets they use for other purchases. These “tap and go” media are ideal for transit because using them is convenient, fast, and secure. There are two main methods of making open payments:

- Contactless EMV bank cards: cEMV bank cards are one of two kinds of EMV (chipped) bank card. Unlike contact EMV bank cards, which must be inserted into a card reader, cEMV bank cards, identifiable by a “radio wave” symbol, are simply tapped on or waved over the card reader target. Through near-field communication (NFC), a form of short-range radio, the reader extracts the card’s data, a process taking a half-second or less.

- Mobile wallets such as Apple Pay, Google Pay, and Samsung Pay: Riders first link a credit or debit card account to their device’s mobile wallet, then make payments by presenting their device to the card reader on an appropriately equipped farebox or validator. The mobile device is read via the same NFC technology used by cEMV bank cards.

Riders expect open payment

Contactless payment media was already in wide use abroad but was relatively new to the U.S. in 2020 with the arrival of COVID-19. The pandemic accelerated adoption of the technology as consumers quickly developed a preference for low-touch payment methods to reduce the potential for virus transmission. The number of open-loop EMV cards used in transit ticketing in the U.S. has risen rapidly from 1 million in 2020 to a predicted more than 13 million in 2025.

Most large retail chains, independent retailers, restaurants, and service providers using modern payment technologies now offer contactless payment, making the technology familiar to consumers and easy to introduce to riders. In addition, cEMV is now the default for debit and credit cards issued by major banking and credit card institutions.

Riders like open payment because it simplifies the transit experience. Riders don’t have to figure out fare structures, know where to get a transit card, download an app, or make sure they have the right amount of bills and coins on hand. They just get on the bus and tap their bank card or scan their mobile wallet, and rest assured they are paying the right fare with the payment method they already have in their pocket or wear on their wrist. Making it easy for riders to pay the fare — especially tourists, first time riders, or occasional riders — removes a significant barrier to transit use and boosts ridership.

With an estimated 12.8 billion EMV cards and mobile wallets in circulation in 2022, and likely more today, open payment clearly has a broad appeal.

As many benefits as open payments provide to riders, they present an even bigger opportunity for transit agencies to streamline their operations, reduce costs, and increase ridership and revenue.

Genfare believes the simplicity of open payment technology will eventually make it the primary form of transit fare payment.

The benefits of open payment

“Three really big things happen when a transit agency goes to open payment,” says Sara Edney, Product Manager at Genfare. “One is the cost of cash collection goes down when less cash is collected. The next is reducing dwell time, which increases route efficiency. The third is that it increases opportunities for frictionless travel across borders or modalities with greater interoperability. These benefits, along with a few others, have major impacts.”

Decreased cash collection

Collecting, validating, sorting, counting, and transporting cash is expensive and time consuming. For every dollar bill a rider inserts into a farebox, it costs the transit agency 10 to 50 cents to process it. As an ardent supporter of equitable mobility, Genfare does not recommend eliminating cash fares, but rather encouraging riders who have the ability to purchase fares open payment to do so.

It’s clear that reducing the amount of cash collected by adopting open payment has many operational benefits to the transit agency, including:

- Reduced maintenance of hardware: Most of the moving parts in a farebox or ticket vending machine are involved in the handling of bills and coins. Less cash coming in means lower maintenance and parts replacement costs, and less time a farebox is out of service.

- Fewer trips through the vault lane: Imagine how much faster buses could return to the garage if they only had to have their fareboxes probed and emptied once or twice a week instead of daily. That means more time on the road, transporting passengers.

- Better security: There are many places in the cash handling process where money can go missing. When using open payment, every cent is accounted for, and no humans are touching the money. Today’s encryption and tokenization methods are extremely secure.

- Faster access to revenue: Even when fareboxes are emptied daily, it can take a couple days before the cash is processed and banked. This keeps cash revenue and reporting lagging behind closed-loop cards and open payment transactions. With open payment, payments are processed in frequent batches and are available the same day, often within hours of when the card gets tapped.

- Less staffing pressure: The less money there is to count and move, the fewer people agencies will need to staff the counting rooms, allowing them to focus on filling customer-facing positions from the limited pool of candidates.

Reduced dwell time

Statistics on dwell time suggest that approximately half the time a bus is in service is spent on boarding. When riders aren’t searching their pockets for and inserting individual bills and coins, and drivers aren’t answering questions and addressing issues related to cash collection, more time can be spent moving. Open payment is tap (or scan) and go, allowing riders to board faster and cutting back on driver interaction with passengers.

Reducing dwell time shortens the time it takes a bus to complete its route. This in turn, makes it possible to run the route more frequently without adding buses, increasing the capacity for riders as well as making the bus a more convenient and attractive choice for riders who have other options. The overall impact is increased ridership and revenue.

Greater interoperability

Open payment and the software that supports it simplifies the connection of adjacent transit agencies, bike and scooter share, parking, and other modalities that move riders along their journeys. When riders can easily and conveniently pay for first-mile/last-mile modalities or transfer from an urban transit agency’s bus to a suburban bus or regional commuter rail without needing a wallet full of smart cards that don’t talk to each other, the providers can more easily coordinate discounts, incentives, and trip planning. And that translates to increased ridership and while not adding the administrative burden of shared fare media.

5 more benefits of open payment

The reasons for transit agencies to adopt open payment go well beyond reducing cash and dwell time and increasing interoperability. It all adds up to a compelling reason to introduce open payment as soon as possible. By adopting open payment, your agency will:

- Reduce reliance on fare media: Banked customers will no longer need to use dedicated fare media, so not only will you need to buy fewer cards, but your workers can also spend less administrative staff time distributing cards and performing customer service functions.

- Have fewer discrepancies: Records of open payment transactions are logged in real-time and reported back frequently. The fares collected will more closely align with the ridership data.

- Easily apply fare structures: When a rider uses the same bank card or mobile wallet for every ride, fare capping and other fare structures can be applied just like they are with a smart card. This means riders can be assured they are paying the lowest fares.

- Conduct real-time monitoring: Data is connected continuously, so you can see irregularities or discrepancies on a route instantly and react accordingly. Genfare Link uses a buses’ existing Wi-Fi router or CAD/AVL connectivity to transmit data in real time.

- Reduce driver interaction: Open payment systems require just a tap or scan and communicate acceptance of payment with their displays and sounds, letting the driver focus on driving and not assisting passengers with paying their fares.

How to adopt open payment

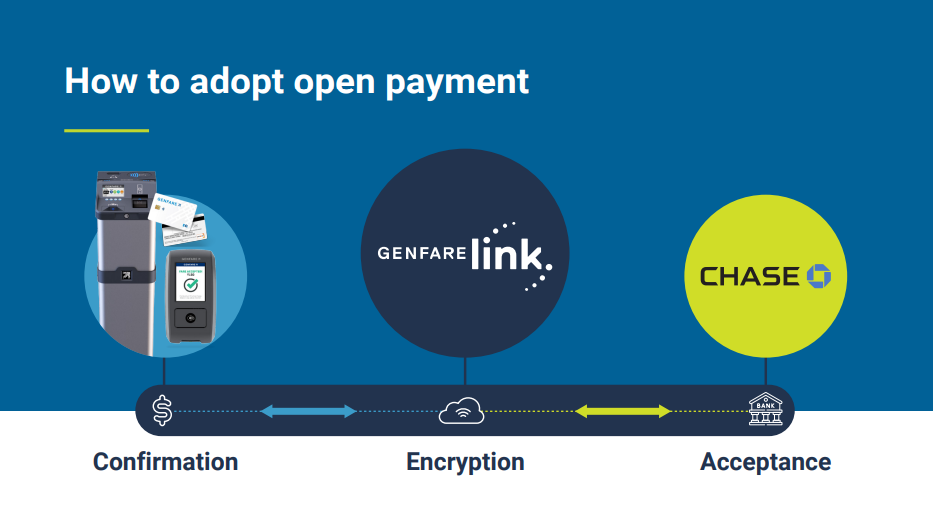

The standard approach for accepting open payment media is defined by the major payment card brands. This procedure allows rapid boarding while keeping cardholder data secure and minimizing the impact of denied cards. Here’s how it works in the Genfare solution.

Confirmation

When a cEMV bank card or mobile wallet (“the card”) is presented to the card reader on a farebox or validator, the reader confirms the card is authentic and checks it against a locally stored “deny list” of declined cards. If the card passes these tests, the rider is allowed to board, even though the transaction hasn’t yet been approved by the issuing bank.

Encryption

Meanwhile, the reader encrypts sensitive cardholder data (card number, expiration date, etc.) using an encryption key. The encrypted transaction is then sent to Genfare Link®, Genfare’s cloud-hosted central data system, which passes the encrypted transaction to the payment gateway. The gateway uses a matching encryption key to decrypt the data and send the transaction request to the issuing bank for authorization. It also tokenizes the transaction for tracking purposes in Genfare Link.

Acceptance

The issuing bank returns an accept or decline message to the payment processor, which relays it to Genfare Link. If the transaction is accepted, Genfare Link records the transaction in a central account database. If the transaction is declined, Genfare Link adds the card number to the deny list, which it broadcasts to all fare collection devices every few minutes. Cards on the deny list go into the debt recovery process next time they are presented. To remove a card from the deny list, the cardholder must pay for rides obtained using the denied card.

Open payment costs

The payment processor serves as the clearinghouse for authorization of payment card transactions. An important consideration in selecting a processor is setup — this can take a year or more if starting from scratch. GenPay, Genfare’s payment processing solution, reduces setup time to a few weeks.

The cost advantage of GenPay

Among the advantages of GenPay, compared to other payment processors, are its simplicity and comprehensiveness.

Simple pricing structure. Some vendors charge separately for third-party fees, annual licensing, add-on services, their own transaction markup, and so on. In contract, GenPay’s pricing structure is simple, consisting of a flat fee based on average ridership volume plus a fixed percentage of the amount per transaction. This charge covers both third-party fees and Genfare’s markup.

Some other vendors also charge a single fee per transaction, but the rate is considerably higher than for GenPay. Genfare imposes no additional charges for licensing and other services, nor is there a minimum annual fee, in contrast to some other vendors.

Fixed transaction fees. For other vendors, processing electronic fare payments involves multiple parties, each of which charges a fee per transaction. These fees, which are ultimately borne by the agency, include interchange and assessment fees, payment brand fees, gateway fees, and acquirer fees. Fees can vary depending on card brand, issuing bank, etc., making it difficult to predict expenses.

In contrast, GenPay absorbs all variation in underlying charges — the transaction fee is solely a function of the payment amount. This makes it unnecessary for agencies to impose fare policies that favor one type of payment card over another.

How Palm Tran added open payment to its fare payment mix

Palm Tran, which serves 28,000 daily riders in rapidly growing Palm Beach County, Florida, recently committed to a complete digital transformation of its transit system. Palm Tran worked with Genfare to upgrade its existing Fast Fare fareboxes to enable the open payment functionality alongside cash, smart cards, and mobile tickets. Today’s riders can just reach into their pockets and use whatever form of payment they have on hand, making the boarding process stress-free and efficient.

Integrate open payment into your transit agency’s long term plans

Agencies considering whether to accept open payment may find it helpful to evaluate their current fare media mix and how they expect it to evolve over time. Points to keep in mind:

- Agencies that currently support in-house electronic fare media, which may include smart cards, mobile ticketing, or both, will likely wish to retain their existing programs while adding the option for open payment acceptance. To accommodate this, Genfare has designed its fare collection systems to accept all electronic media. The same card reader can be used to process closed-loop and open payment cards, and the Fast Fare farebox and Open Link validator can both process barcoded mobile tickets.

- Agencies that don’t currently issue their own smart cards, including many smaller operators, may find open payment lets them accept electronic payment while avoiding some of the investment needed for closed-loop smart cards, such as ticket vending machines or point of sale equipment. The administrative overhead required for open payment acceptance is the same as for any merchant accepting credit or debit cards.

- Agencies that use agency-branded mobile apps may eventually see their use supplanted by payments through mobile wallets such as Apple Pay, Google Pay, and Samsung Pay, but until the direction of the market becomes clear it seems wise to accept both – the capital outlay to accept barcoded mobile tickets is modest.

- Agencies collecting cash or using traditional fare media may want to consider not eliminating them when modernizing. Title VI of the Civil Rights Act of 1964 requires that transit agencies receiving federal funding demonstrate that fare collection improvements do not work to the detriment of disadvantaged minorities. At minimum, agencies choosing to accept open payment media will wish to continue taking cash, since a significant fraction of riders do not have bank cards or smart phones. It is also advisable to think twice before discontinuing traditional media such as magnetic cards, which continue to be useful to social service agencies needing low-cost tickets for distribution to their clients.

Genfare believes open payment is well worth the investment and warrants consideration by all transit agencies regardless of size or technical resources. Genfare’s open payment solution offers simplicity and comprehensiveness unmatched by other vendors.

Related Products

Future-proof fare collection

Imagine the power of having every aspect of your transit system – and every user – connected by compatible hardware and software. Learn how Genfare leverages the Internet of Things to help your agency increase ridership and raise revenue with our simplified, empowered, and connected equitable mobility solutions.