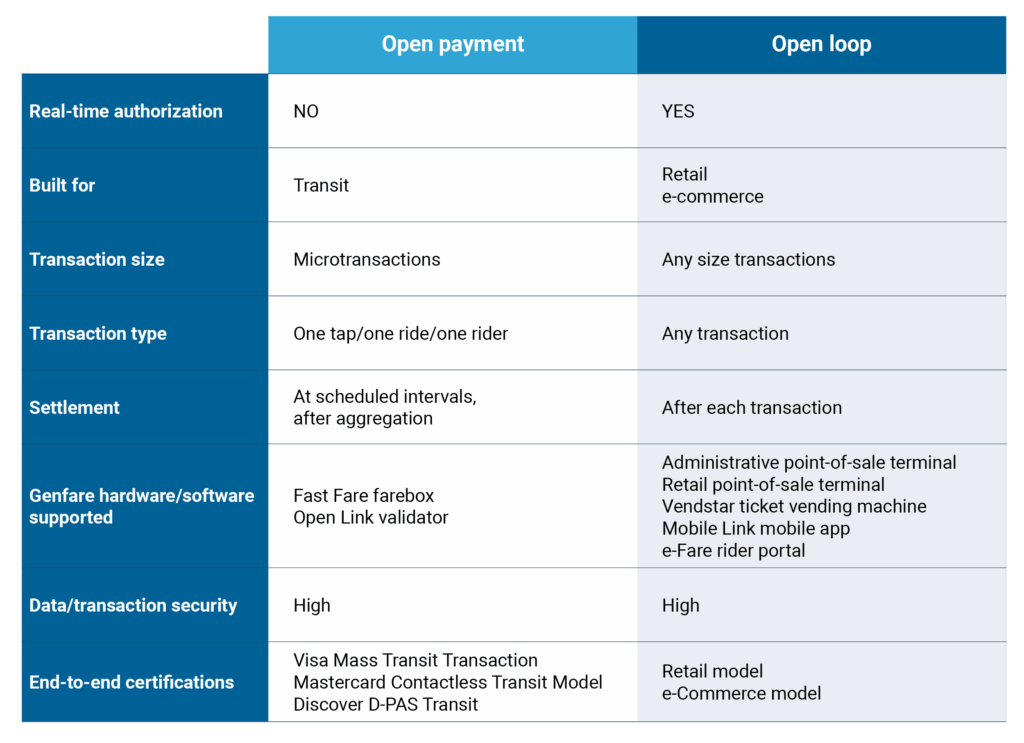

The terms open payment and open loop are often used interchangeably to describe contactless bank card and mobile wallet transactions, but they are not the same. They are two different payment methods with one very important difference – real-time authorization.

Open payment is built for transit.

Open payment supports contactless bank card and mobile wallet microtransactions without real-time authorization.

Open loop is built for retail and e-commerce.

Open loop supports contactless bank card and mobile wallet transactions of all sizes with real-time authorization.

Why open payment and not open loop on board?

The validator on Genfare’s Fast Fare farebox is certified for single-transaction use and accepts open payment microtransactions. This means each tap can only pay for a single ride for a single rider. There are good reasons for this:

- Faster boarding: By eliminating real-time card authorization, riders can board more quickly instead of waiting for the farebox and the bank to communicate in both directions. This keeps buses on schedule.

- Lower risk: Because there is no real-time authorization, only small payments are accepted. To reduce, but not eliminate, the risk of payments going unfunded by the issuing bank, the farebox maintains a “bad list” (aka “deny list”) of cards that have previously been rejected and will not accept them.

- Better ridership data: Because each tap equals one ride, the real-time data produced by open payment accurately reflects ridership.

- Less reliance on connectivity: Transit vehicles often lose connection to cellular or Wi-Fi networks when they are in areas where the built or natural environment blocks signals or that aren’t yet covered by wireless service. Constant connectivity is required for the real-time open loop authorization. With open payment, a PCI-PTS certified device can securely store encrypted transaction data for transfer when network connectivity is resumed.

Open payment vs. open loop at a glance

What about larger purchases at the farebox?

For the reasons listed above, Genfare fareboxes and validators do not support larger transactions such as period pass purchases. However, due to customer demand, Genfare is currently pursuing Retail Transaction certification to make selling period passes or other larger transactions on board possible in the future.

Period passes

Period passes can currently be purchased off-board only. The following Genfare retail solutions are certified for open loop transactions that require real-time authorization:

- Mobile Link mobile app

- e-Fare online rider portal

- Vendstar ticket vending machines

- Administrative point-of-sale terminal

- Retail point-of-sale terminal

Fare capping also offers a work-around for period passes. It does not require a rider to pre-purchase the pass on their phone, tablet, or computer, at a transit center or at a participating retail or community location. Instead, the rider continues to tap their contactless card or mobile wallet at the farebox or freestanding validator to purchase single rides and stops being charged when they have met the period pass threshold.

Family/group riders

Open payment supports a only a single ride/single rider for each tap. However, this does not prevent a rider from tapping their card or mobile wallet multiple times, allowing everyone in their family or group to pay their fares on a single bank or credit card account.

How open payment works

The standard approach for accepting open payment is defined by the major payment card brands. This procedure allows rapid boarding while keeping cardholder data secure and minimizing the impact of denied cards. Here’s how it works in the Genfare solution.

Confirmation

When a cEMV bank card or mobile wallet is presented to the card reader on a farebox or validator, the reader confirms the card is authentic and checks it against a locally stored list of declined cards. If the card passes these tests, the rider is allowed to board, even though the transaction hasn’t yet been approved by the issuing bank.

Encryption, aggregation, and tokenization

The farebox immediately encrypts sensitive cardholder data (card number, expiration date, etc.) using an encryption key. The encrypted transaction is then sent to Genfare Link®, Genfare’s cloud-hosted central data system, which aggregates and tokenizes the data before sending the transaction request to payment processor, then on to the issuing bank for authorization.

Acceptance and settlement or debt recovery

The issuing bank returns an accept or decline message to the payment processor, which relays it to Genfare Link. If the transaction is accepted, Genfare Link records the transaction in a central account database. If the transaction is declined, Genfare Link adds the card number to the deny list, which it broadcasts to all fare collection devices every few minutes. Cards on the deny list go into the debt recovery process next time they are presented. To remove a card from the deny list, the cardholder must pay for rides obtained using the denied card.

Upgrading to open payment is easy

If your existing fare collection solution is nearing the end of its life, it just makes sense to include open payment technology when you replace it. But if you still have years left on your current fareboxes, you have options: Existing Fast Fare® fareboxes can be upgraded to accept open payment by adding a kit. If you have a legacy Genfare farebox and are not ready to invest in Fast Fares, an Open Link validator can be mounted to a stanchion or pole and connected to the farebox. To explore your transit agency’s options, contact your regional Business Development Director.