GenPay allows transit agencies to simply, securely and cost-effectively accept bank card payments on the bus, as well as at any online or retail sales channel, with a single-vendor bank card processing solution.

Highlights

- Secure PCI Level 3 certified

- Simple fee model

- Single-vendor turnkey bank card processing

Simplified

GenPay is single-vendor, turnkey bank card processing solution, streamlining support and accelerating revenue collection across channels. It has a simple fee model with no tiers to reach, no minimums, and no additional fees to use purchased products.

Empowered

GenPay partners with leading U.S. merchant services providers to process Discover, Visa, and MasterCard payments. Funds are directly deposited into the agency’s account and are immediately available for use.

Connected

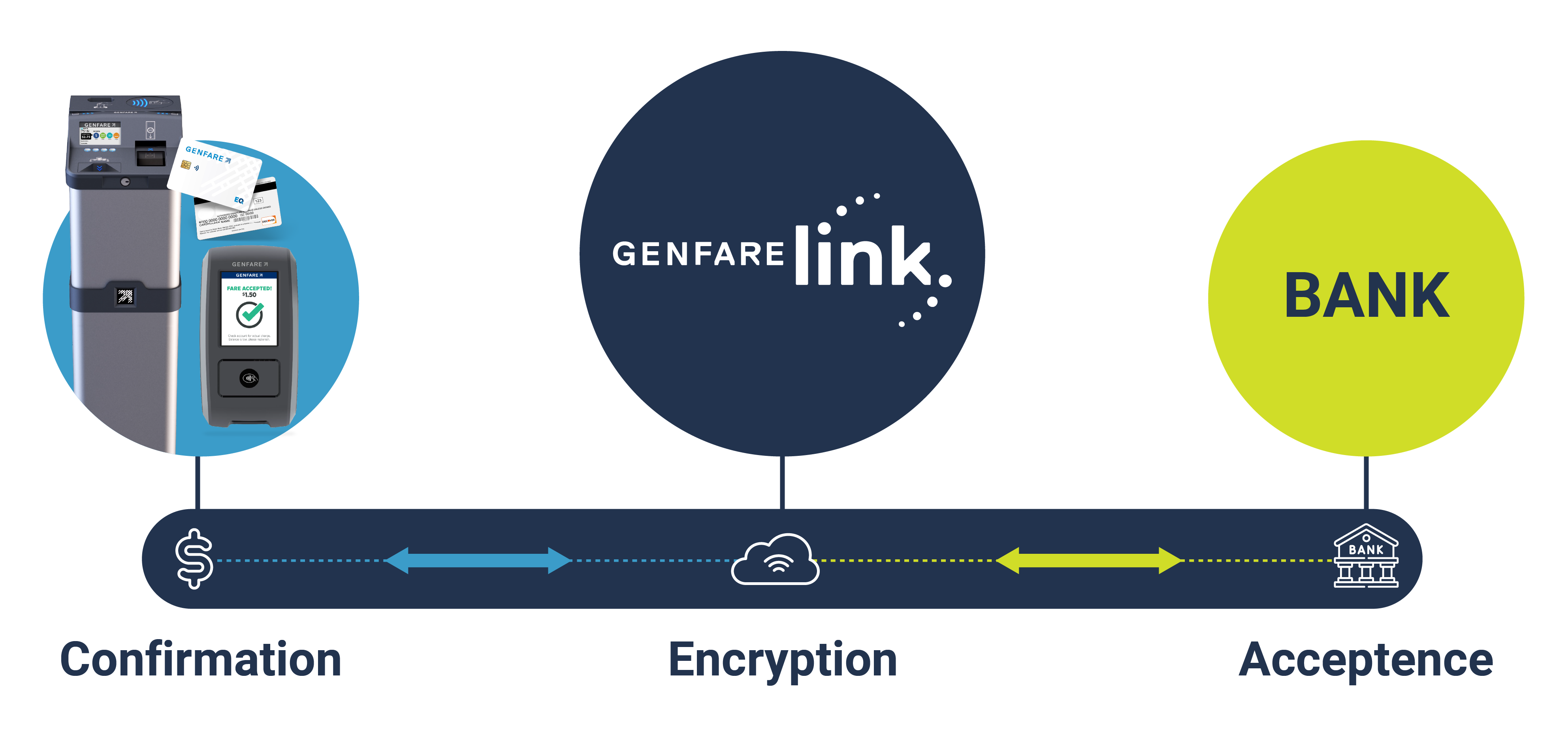

GenPay is powered by Genfare Link®. Reporting, customer service, and other functions are easy to access in Genfare Link’s administrative interface. GenPay works with all Genfare sales channels accepting bank card payments.

Secure

GenPay’s tokenization process anonymizes sensitive card information and ensures only the bank receives credit card information, reducing the risk of data breaches and building trust with riders.

The advantages of GenPay payment processing

Among the advantages of GenPay, compared to other payment processors, are its simplicity and comprehensiveness.

Simple pricing structure

A flat fee based on average ridership volume plus a fixed percentage of the amount per transaction, and that’s it. No additional charges, no licensing, no minimum annual fee.

Single vendor solution for all channels

All electronic payments, no matter the device or channel, are processed through the same service. This makes customer service and other administrative tasks much simpler.

Simplify secure bank card processing with GenPay.

Related Products

Journey with Genfare

We want to elevate transit, not just for riders, but also for the agency and the whole community. Learn how Genfare can help your agency increase ridership and raise revenue with our simplified, empowered, and connected equitable mobility solutions.