Fare evasion is a persistent problem that costs transit agencies millions and can erode support for public transit systems, as outlined in part 1 of this series. This post explores specific strategies for reducing evasion losses and successfully recovering fare debt.

By keeping fare evasion under control, transit agencies can increase revenue and improve public confidence in transit while better supporting equitable mobility, says Sara Edney, engineer and product manager at Genfare. Agencies can tackle the problem with low-cost operational changes, data-driven enforcement, and optimized fare collection technology, she says.

Here is where to start:

4 budget-conscious strategies that combat fare dodging

1. Gather data

Data-driven insights help precisely target fare evasion problems, keeping enforcement programs and tech investments as efficient and low-cost as possible. To gather the most useful information, agencies can:

- Use existing validator and backend data to identify:

- Tap failures or rejections

- Routes or stops with unusually low fare collection

- Trends in time-of-day or vehicle type fare evasion

- Review vehicle boarding counts using automated passenger count logs or driver logs and compare with fare transactions to estimate discrepancies

2. Use targeted enforcement

To better pinpoint fare evasion trends and reduce costs, agencies can:

- Focus on fare inspection or operator spot-checks on high-risk routes, times, or stops.

- Partner with local police or security only where necessary. This avoids criminalizing riders and puts the focus on compliance education.

3. Maximize the use of existing infrastructure

Clear communication, the right tools, and well-maintained equipment are keys to consistent fare collection. Agencies can focus on:

- Better signage and rider messaging: Make it clear what the fare policy is, how to pay, and remind riders that evasion is being monitored.

- Improved operator support: Give bus operators tools or training to flag repeated fare evaders or issue proactive reminders without confrontation.

- Utilize onboard tools: For agencies with validators, ensure they are functioning properly and visible to riders. For agencies using an honor system, operators or enforcement agents can carry a handheld device to recover fares from riders who haven’t paid.

4. Combine smart policies with digital deterrence

- Consider fare capping or flexible fare models that reduce the rider’s incentive to evade due to cost.

- Use backend rules to reduce payment abuse, such as limiting repeated tap attempts on known declined cards.

- Blacklist known fraudulent cards or patterns.

Capital District Transportation Authority (CDTA) in Albany, New York, succeeded in deterring short fares with the latter strategy. Previously, the agency’s program for reduced-fare riders required visual card inspection by the operators, allowing some non-eligible riders to take advantage and pay half fares.

A switch to the cloud-based Genfare Link system allowed CDTA to begin using smart cards, obtained in person. With just one tap of the smart card, all fare types were automatically calculated, secured, and validated on the back end without the need for operator intervention.

Innovative hardware and software curb fare evasion

Modern hardware and software give agencies a wide range of capabilities for pinpointing fare evasion trends and deterring attempts to dodge payment, Sara Edney says. This can include everything from a fare evasion button on the operator control unit (OCU), to farebox software that records non-payment data, to physical barriers such as faregates.

“You want to dissuade people from evading fare payment because this behavior dissuades others from wanting to pay,” Edney says. “This is where innovative technology is your friend.”

Edney recommends that agencies focus on enforcement in areas with high evasion by using technology that gives them multiple options for tracking and managing fare-evasion deterrence and interoperability with other solutions.

“With a cloud-based fare collection platform, for example, agencies can identify non-payment so that they can better react to trends,” she says. For example, the agency can set their OCUs to track fare evasion and train bus operators to use a fare evasion button each time someone fails to pay. The software records each incident and can produce a trend analysis, so the agency knows the stops, routes, and times of day when people are evading fares.

Invalid cards also go on a bad card list, and the farebox will show a symbol such as a red X and make an audio signal as well. The rider won’t be able to ride on that card for a pre-determined period.

“Smart cards can hold a negative balance. If a card goes negative in any amount, it will be put on the bad list and will not be valid the next time the rider uses it,” Edney explains. “We can also identify short fares. If someone doesn’t put in the full fare, this is tracked by route, driver, and bus garage. If they put a quarter in the farebox and walk on, we can see that.”

Sometimes peer pressure is helpful as well, kicking in when a bad card triggers a noise from the farebox, she adds. Integrated fareboxes and validators with clear alerts can also discourage passback (when riders give others their card to use) and improper payments.

Open payment processing and debt recovery

Modern payment options are another tool that can aid fare dodging deterrence, says Vicky Tuan, payment processing manager at Genfare. Open payment, a type of contactless payment in which riders use their existing credit/debit cards or mobile wallets to pay fares, not only streamlines boarding, but allows for more effective fare enforcement.

Open payment systems can automatically apply fare caps as well, ensuring the correct fare is paid. Real-time monitoring and data analysis help agencies identify and react to discrepancies, making evasion harder to conceal.

“We do offline data authentication on the bus, and if we can’t settle the transaction, the card will get put on the bad list,” Tuan says. “But a lot of riders take advantage of this because the agency has a let-them-ride policy, or the driver does not ask the rider to exit the bus due to safety concerns, so some riders keep using the same bad card repeatedly. That’s when we turn to debt recovery, and we do recover a lot of funds this way.”

Ways to recover fare debt

When a card is on the bad list, there are ways for agencies to successfully recoup whatever is left on the balance, Tuan says. Here are some strategies to consider:

When a card is on the bad list, there are ways for agencies to successfully recoup whatever is left on the balance, Tuan says. Here are some strategies to consider:

- Automated, tap-initiated debt recovery. For example, a Fast Fare farebox uploads transactions every five minutes, Tuan says. But if the card is recognized as bad, it will upload right away, requiring a first tap for what the rider owes and a second tap for the current ride.

- Bulk manual retry for debt recovery. “One agency did that right around the time when people receive their tax refunds. They had a lot of success with recovery,” Tuan says. “Such a method can also be scheduled for typical paydays.”

- Setting thresholds for tap attempts. Genfare Link allows agencies to specify how many times a new or denied card can be tapped for immediate authorization, which can prevent transaction fees from being charged to the agency.

- Give riders a payment portal option. The agency’s fare collection solution can be set up so that riders can go to the e-Fare portal to settle their debt, taking them off the bad list, Tuan notes.

Genfare can help

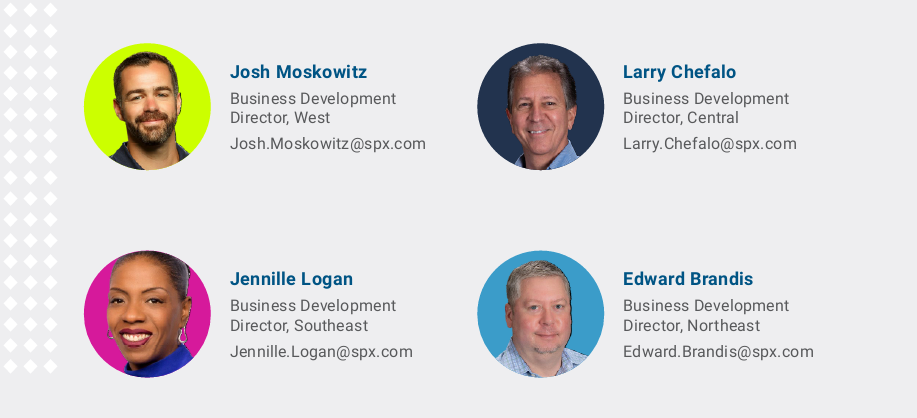

Genfare partners with agencies to deter fare evasion through configurable tools that adapt to an agency’s fare policy and evasion challenges. Contact your region’s business development director to learn more about solutions such as:

- Improved real-time fraud detection.

- Customizable fare logic and enforcement thresholds.

- Transaction exception flags and analytics dashboards.

- Integration with third-party security and enforcement systems.

- Mobile validation and enforcement tools that support proof-of-payment efforts.

- Education and training for operators and fare inspectors.

- Ongoing reporting and data analysis to adapt strategies based on real-world use.